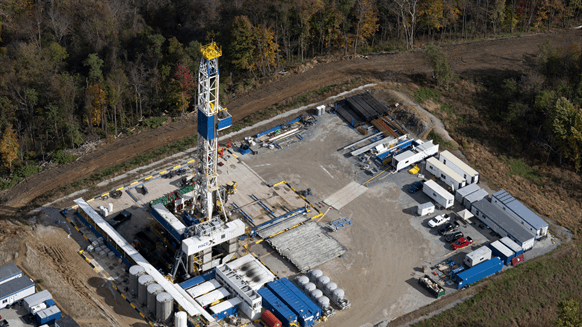

Suriname, which is on the verge of turning into a serious South American power producer, is ruling out extra borrowing in opposition to future oil manufacturing, in accordance with its finance minister.

TotalEnergies SE and APA Corp. this month introduced a $10.5 billion offshore venture that may start pumping crude as quickly as 2028. Minister of Finance and Planning of Suriname Stanley Raghoebarsing mentioned the nation isn’t contemplating loans which might be assured by these revenues, regardless of listening to gives from brokers in Washington this week.

“Under no circumstances will we need to pre-sell oil that we nonetheless need to elevate, and collateralize that for straightforward cash that may burden the following technology,” he mentioned in an interview on the sidelines of the Worldwide Financial Fund and World Financial institution annual conferences.

The feedback present a window into how one of many world’s latest oil patches is approaching its forthcoming bounty, which the state oil firm estimates might herald as a lot as $26 billion. The prospect of an enormous windfall helped it win a double-notch credit score improve from Moody’s Rankings this week, which lifted the nation to Caa1 — nonetheless deep in junk degree — with a optimistic outlook.

The $4.9 billion financial system is forecast to develop 3% this yr, in accordance to the IMF.

A yr in the past, the federal government finalized a debt restructuring that included so-called value-recovery devices that pay buyers a portion of income from oil after it begins flowing.

The value for these securities has greater than double to round 101 cents on the greenback over the previous yr. Sovereign bonds, in the meantime, which might be due in 2033 have returned 13% this yr, double that of emerging-market friends, in accordance with knowledge compiled by Bloomberg.

Raghoebarsing mentioned the federal government isn’t contemplating promoting extra of the oil-linked devices. “Some persons are saying that we’d like extra funds and we we need to promote the VRI,” he mentioned. “We’re not going in any respect doing down that street.”

Buyers have additionally proposed shopping for again a few of that debt early by means of mechanisms together with debt-for-nature swaps. Raghoebarsing mentioned the federal government weighed the thought however concluded that they weren’t value it.

IMF Program

The nation will wait till after Might’s nationwide elections to resolve on whether or not to ask for a brand new program with the Worldwide Financial Fund after the present $688 million deal expires in March, Raghoebarsing mentioned.

Within the meantime, the nation this week signed an settlement with the World Financial institution to be included within the checklist of Worldwide Growth Affiliation nations. That can unlock about $22 million of concessional financing that might be used to enhance residing circumstances within the capital, Paramaribo.

He mentioned the nation of roughly 650,000 has to rigorously steadiness the newfound wealth that may include oil discoveries. It has established a sovereign wealth fund for these revenues and is adapting the legal guidelines governing it in order that funds out there for use within the funds.

The legislation is being modified, “in order that right this moment’s technology doesn’t really feel as when you’re placing the whole lot for the longer term generations and we’re struggling,” he mentioned. “You care for right this moment’s technology and also you just remember to are caring for the following generations.”

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluation. Off-topic, inappropriate or insulting feedback might be eliminated.

MORE FROM THIS AUTHOR

Bloomberg