Ecopetrol SA postponed a proposal to promote $1.75 billion of greenback bonds after Colombia’s electoral council launched an investigation involving the nation’s president and the state oil driller’s chief govt officer, in accordance with folks accustomed to the matter.

The corporate determined in opposition to shifting ahead with the transaction this week, although it could contemplate returning to the market sooner or later, the folks mentioned, asking to not be recognized as the choice hasn’t been made public.

In reply to a request for remark, Ecopetrol mentioned the method hasn’t ended and that any related info can be launched in a regulatory submitting. JPMorgan Chase & Co., one of many leads on the deal, declined to remark. Representatives for the opposite two — BBVA Securities Inc. and Santander US Capital Markets — didn’t reply to messages in search of remark.

Ecopetrol’s American depositary receipts rose 1.6 % in New York Thursday, snapping a two-day shedding streak, whereas bonds edged decrease, in accordance with Hint knowledge.

The corporate, which is majority owned by the Colombian authorities, opened the sale course of on Tuesday, in search of to borrow from capital markets for the second time this 12 months to fund a debt buyback. Phrases had been set, together with a yield of seven.65 %, however the deal by no means priced, in accordance with the folks.

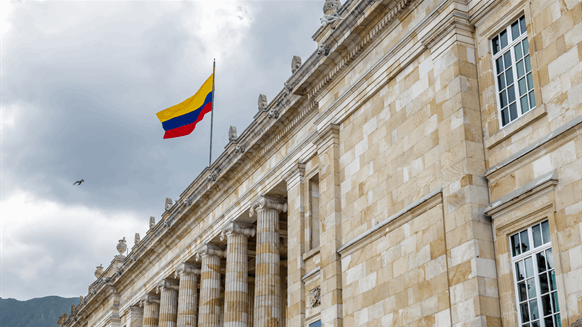

The choice to postpone the providing comes after electoral council magistrates began an investigation into an alleged breach of marketing campaign financing limits, naming President Gustavo Petro and Ecopetrol CEO Ricardo Roa as targets. Roa ran Petro’s 2022 presidential marketing campaign earlier than being appointed to the Ecopetrol publish final 12 months.

After a unprecedented assembly, Ecopetrol’s board on Wednesday mentioned it helps Roa and can proceed to watch the investigation.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial assessment. Off-topic, inappropriate or insulting feedback can be eliminated.

MORE FROM THIS AUTHOR

Bloomberg