Woodside Power Group Ltd. has assumed management of the U.S. Gulf Coast Driftwood LNG undertaking after finishing its acquisition of Tellurian Inc. for about $1.2 billion.

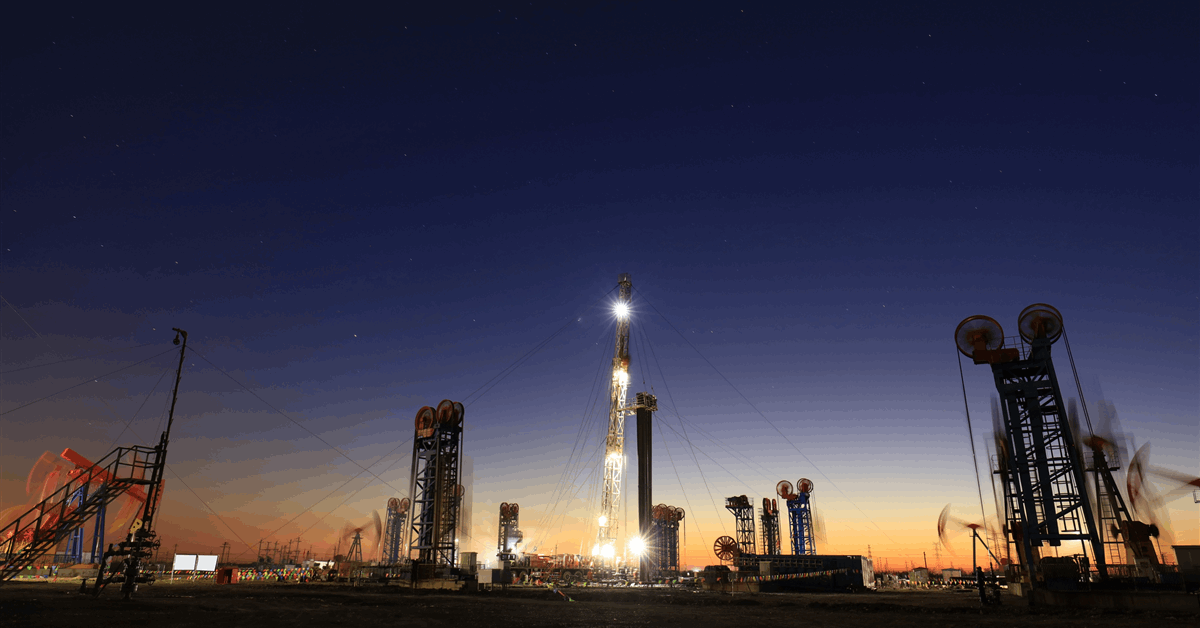

The under-construction undertaking, which has but to succeed in a last funding resolution, is deliberate to have a capability of 27.6 million metric tons each year (MMtpa). Woodside has now renamed it Woodside Louisiana LNG.

“This can be a main development alternative that considerably expands our US LNG place, enabling us to higher serve international clients and seize additional advertising and marketing optimization alternatives throughout each the Atlantic and Pacific Basins”, chief govt Meg O’Neill mentioned in an organization assertion Wednesday.

The undertaking has accomplished its front-end engineering design and secured all permits. “… website civil works are effectively superior”, O’Neill mentioned.

“Woodside is focusing on FID readiness from the primary quarter of 2025, with the skilled Tellurian crew and engineering, procurement and building contractor Bechtel having accomplished substantial work to advance the chance to this stage”, O’Neill mentioned.

“We’re additionally happy with the inbounds obtained from a number of events trying to enter the chance as a strategic associate”.

The Australian firm paid the acquisition, introduced July 22, with round $900 million in money, or $1 per frequent share, for the inventory portion. The enterprise worth of roughly $1.2 billion “consists of s $50 million for Tellurian’s Sequence C Convertible Most well-liked fairness shares, ~$65 million of web debt, ~$20 million web working capital adjustment, ~$50 million for administration and debt change of management prices and ~$135m of interim funding from signing to shut”, Woodside mentioned.

Tellurian additionally had upstream property however offered these simply earlier than the transaction with oil and gasoline explorer and producer Woodside. The property within the Louisiana Haynesville and Bossier shale basins, in addition to gathering and treating programs which have an mixture capability of 100 million cubic ft a day, went to Aethon Power Administration LLC for $260 million.

The upstream properties are nonetheless anticipated to provide the LNG undertaking beneath Woodside. Alongside their sale settlement, Aetheon and Tellurian additionally signed a heads of settlement to assist the event of the liquefaction facility.

“The Heads of Settlement contemplates the events negotiating a 20-year offtake settlement which might be listed to Henry Hub plus a liquefaction charge, with acceptable credit score assist, to supply the idea for undertaking financing of Driftwood LNG”, Tellurian mentioned in a press launch Might 29.

“Aethon will proceed to discover further alternatives to convey worth to Driftwood LNG following the [upstream sale] transaction”.

Earlier Woodside accomplished one other acquisition, taking up OCI International’s ammonia manufacturing undertaking in Beaumont, Texas. The power, which Woodside purchased for $2.35 billion, has a deliberate capability of 1.1 MMtpa. It’s anticipated to start out producing ammonia subsequent 12 months and lower-carbon ammonia 2026.

“As a world power supplier, Woodside is targeted on decrease carbon ammonia and its more and more necessary function on the earth’s power combine”, O’Neill mentioned in an organization assertion September 30 asserting the closure of the transaction.

To contact the writer, e mail jov.onsat@rigzone.com

What do you suppose? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our business, share information, join with friends and business insiders and interact in knowledgeable neighborhood that may empower your profession in power.